Trust Services

Online Trust Account Access (Infovisa) Visit Now

Personalized Service from the Trust Department at F&M Bank

People tend to shy away from conversations that deal with unpleasant topics, such as passing on your assets after your death. At F&M Bank, we find these conversations, as unpleasant as they are, to be important when preparing for the future. The Trust Services we offer help you decide if a trust is right for you, and ensure your assets and loved ones are secure.

Defining a Trust

In short, a trust is custom-tailored legal agreement that instructs a trustee how to hold, manage and invest any assets that are a part of your trust account. There are many different kinds of trusts, each with their own benefits and restrictions:

- Living Trust- a trust you create during your lifetime.

- Testamentary Trust- a trust created in your Last Will.

- Revocable Trust- a trust you maintain control over.

- Irrevocable Trust- a trust that cannot be amended, modified, changed or revoked.

Benefits of Using a Trust- Protection

The main purpose of using a trust is protection, which comes in many different forms depending on the trust option you choose:

- Protection for your assets and property through a trust professional having responsibility over your investing and managing your assets

- You and your family are protected if you become disabled and incapable of managing your affairs.

- Protection for your spouse, children and grandchildren if they cannot handle financial matters.

- Protecting your estate by paying taxes on it upon your death.

- Your ability to leave property to whomever you choose is protected.

- Most importantly, your privacy is protected as a trust is a private arrangement between you and your trustee.

Choosing a Trustee- A Crucial Choice

Appointing your trustee is one of the most important decisions you can make related to your trust account. While a trust document can be very well written, it is useless if the trustee fails in their duty to uphold it. A trustee should:

- Be committed to the trust for many years

- Be experienced in handling trusts in a professional manner

F&M Bank has a proven record of being a dependable trustee. When you choose us as your trustee, you and your family can expect personalized service from our professional staff throughout the duration of the trust account.

Other Trust Services at F&M Bank

F&M Bank also offers other trust services:

- Investment Custody- for those who want to be more active in how their assets are invested.

- Estates- provides complete administration of your estate from probate of the will to filing the final settlement.

- Guardianship accounts- as guardians, we are qualified to safeguard assets, inventory assets for review by probate court, manage and invest assets, pay ongoing debts and obligations, prepare and file financial accountings for review by probate court, prepare and file final financial accounting when the guardianship ends, and more.

- Bill Pay Account- includes monthly bill payments, earns a competitive rate of interest and review in invoices and proper handling of financial payments.

- Investment Management- focus on important things in your life while F&M Bank handles your asset investments as your investment manager.

- Individual Retirement Accounts (IRAs)-allows you to defer taxes on savings until time of distribution.

- Individual Retirement Account (Roth IRA)-While a Roth IRA has no current tax deduction, earnings and distributions from a Roth IRA are generally tax-free.

- IRA Rollovers-The requirements for IRA rollovers can be overwhelming for individuals. Let our Trust Department assist you!

- Simplified Employee Pension Plan (SEP)- Allows employers to maintain a retirement program with a minimum amount of paperwork and regulatory compliance.

- Savings Incentive Match Plans for Employees (SIMPLE)-Retirement savings instrument for small employers.

- 401(k) Plan-Profit-sharing plan allowing employees to make tax-deferred contributions with a possible employer match.

- Farm Management- we offer a number of services to assist clients with their personal farm goals, including the selection of competent tenants or farm operators and the negotiation of appropriate and fair operating leases.

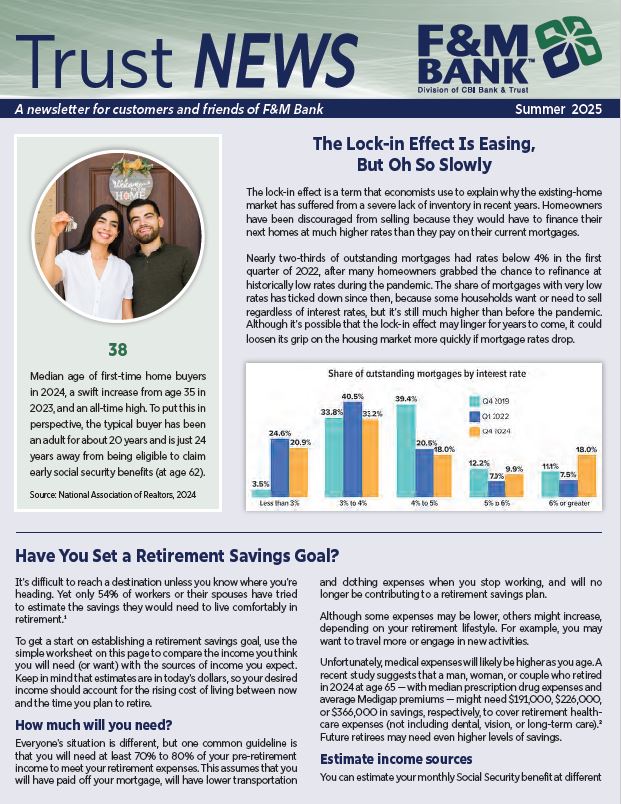

Enjoy our Trust Newsletter!

We send an interesting, informative Trust newsletter to our clients on a regular basis – just one of the many benefits of being an F&M Bank client!

Click on the image below to access the most recent issue:

Contact an F&M Trust Department Staff Member

As trusts can be complex and influenced by a number of factors, we like to start with a personal appointment where we get to know you and your needs. Contact any of the F&M Trust Department staff members to arrange an appointment today.

Jon Holthe, Senior Vice President, Senior Trust Officer

309-343-0002 ext. 20605

Tom McIntire, Vice President, Regional Senior Trust Officer

309-344-2450

Jenna Swearingen, Trust Administrator II

309-344-2451

Both FDIC-insured deposits and non-deposit investments products are available through the Trust Department. Non-deposit investments products are:

• Not FDIC Insured • Not Bank Guaranteed • May Lose Value • Not A Deposit • Not Insured By Any Federal Government Agency